Understanding Your Property Tax Bill: A Step-by-Step Guide

Part 1 (Series on Property Taxation in Montana) Update for the 2025 Tax Year

November 4, 2025

By Greg Gilpin

Property tax statements can often be confusing, and filled with unfamiliar codes, values, and terminology. If you're like many homeowners, you might find it easier to pay the bill rather than uncode the details. Understanding your property tax statement is essential, as errors can occur, potentially leading to overpayment.

In this first post, we'll explain the key components of a property tax statement:

- Market Value: Estimated price a property would sell in the current market.

- Taxable Percent: Rate applied to your property’s market value to determine the taxable portion of your property.

- Taxable Value: Value of your property subject to taxation.

- Mill Levy: Property tax rate.

- Property Tax: Amount of taxes owed.

With these terms demystified, you'll better understand how your property taxes are

calculated and what factors influence your taxes owed.

1. Market Value

Market Value refers to the estimated amount a property would sell for in an open market

under normal conditions. It represents the price that a willing buyer and seller would agree upon in a transaction.

Market value is the foundation of the property tax system and plays a key role in

determining a property owner's share of the total tax burden.

1a. How Market Value Is Determined in Montana

In Montana, the Department of Revenue (DOR) is responsible for appraising properties

to determine their market value. Each property is categorized into one of 16 property classes, based on their use, ownership, and specific legal provisions. There are valuation

methods specific to each class, ensuring that all properties within a class are assessed

using the same methods.

Montana operates on a valuation cycle, meaning properties are periodically reassessed based on current market conditions and updated data. For instance, residential properties were reassessed in 2025 for the 2025-2026 cycle, with the next reassessment scheduled for 2025.

To provide transparency, the Montana Cadastral database offers a search tool where the public can access detailed information on property values and taxes for any Montana property.

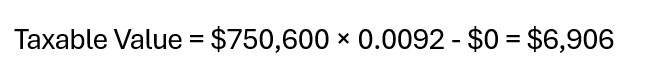

Example

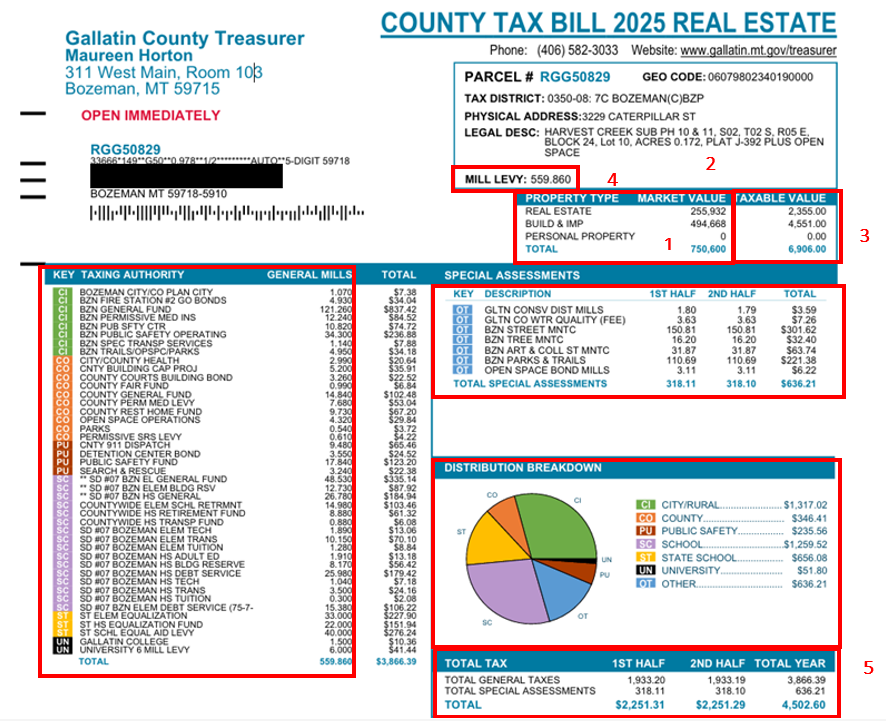

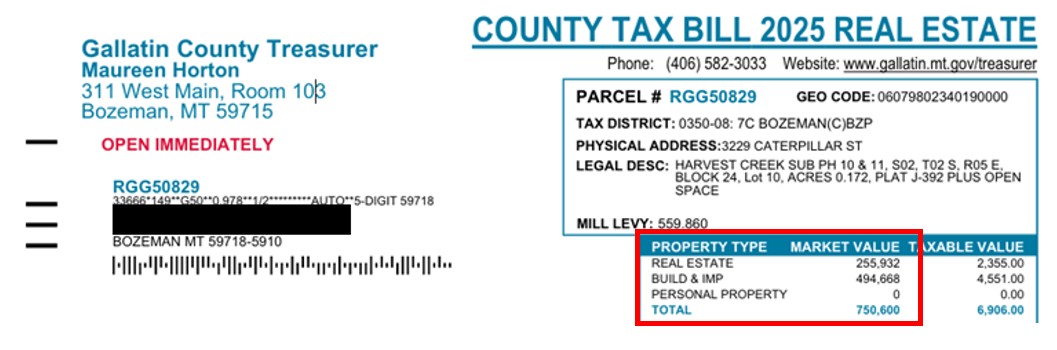

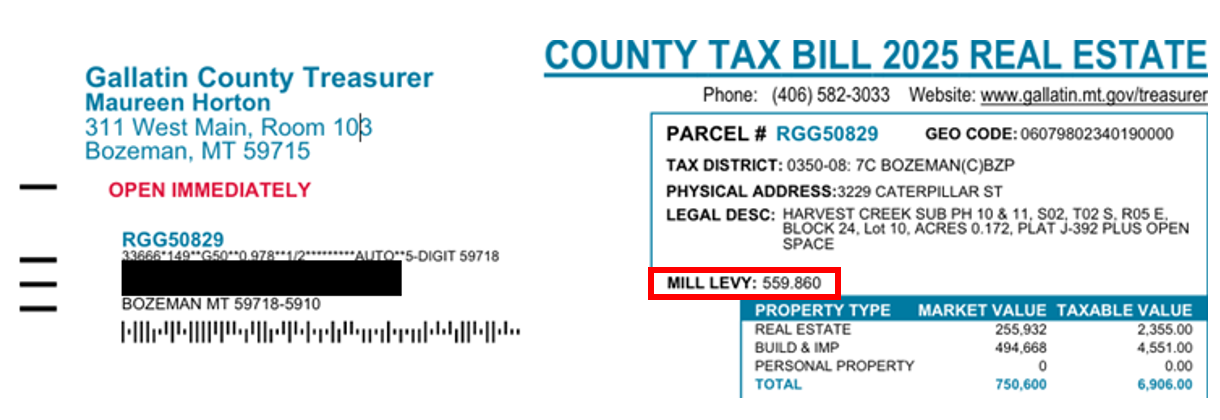

In 2025, an example residential property located in Bozeman was appraised by the DOR with a market value of $750,600.

1b. Appealing a Property’s Value

If a property owner believes their assessed market value is incorrect, they have the

option to appeal the appraisal. This process typically involves submitting evidence

that supports the claim, such as recent sales data from comparable properties or an

independent appraisal. For detailed instructions on how to file an appeal, visit the

DOR’s website.

2. Taxable Percent

The Taxable Percent determines how much of a property’s market value is subject to

taxation. The Montana State Legislature sets the taxable percent for each class of

property. In 2024, there were 1,145 distinct property class codes, each with its own taxable percent. However, most properties in Montana fall under

one of four primary class codes:

| Property Type | Taxable Rates |

| Residential (≤$400K) | 0.76% |

| Residential ($400K - $1.5M) | 1.10% |

| Residential (>$1.5M) | 2.20% |

| Commercial (≤$400K) | 1.40% |

| Commercial (>$400K) | 1.89% |

| Qualifying Agricultural Land | 2.05% |

| Forest Land | 0.37% |

Example

For the example statement, the property class is residential city/town lot and has a taxable rate of 0.92%.

Things to note:

- Round this average taxable rate to the nearest hundredth of a percent to match DOR’s calculation. 0.009188 ~ 0.0092

- If a residential property value is less than $400K, then the average taxable rate is 0.0076.

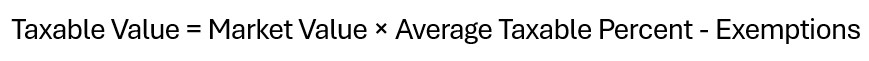

3. Taxable Value

In Montana, the Taxable Value refers to the portion of a property’s market value that is subject to taxation. It

is determined using the market value, the average taxable percent, and any applicable exemptions:

Example

In the example tax statement, the market value is $750,600, the average taxable percent is 0.92%, and there are no applicable exemptions. Thus, the taxable value is $6,906.

3a. Exemptions

In Montana, property tax exemptions are determined by property class codes. Each property

class has different types of exemptions that can reduce or eliminate taxable value.

Common exemptions include the Property Tax Assistance Program, Elderly Homeowner and

Renter tax Credit, Disabled Veteran Program, and the Intangible Land Value Property

Exemption. For further details, check the Montana Department of Revenue website for the most up-to-date information on exemptions and eligibility criteria.

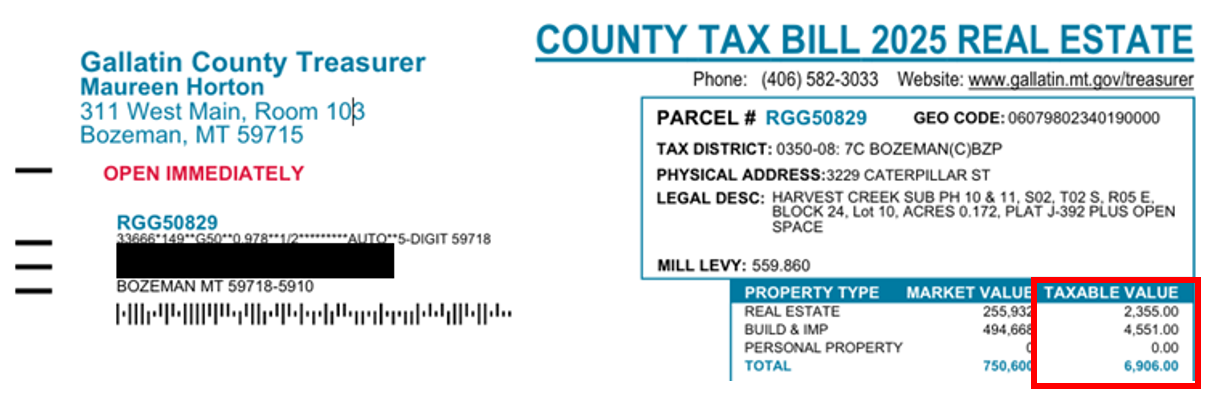

4. Mill Levy

The Mill levy is the property tax rate applied to the Taxable Value of the property.

For example, a property with a taxable value of $6,906 will pay $6.91 for each mill levied.

Each taxing jurisdiction (state, county, city, etc.) levies mills to properties within its boundaries to meet

its budget needs. The amount property owners pay is based on the total mills levied

from all applicable jurisdictions.

Property tax statements itemize the specific mills levied, including a description

of the government services provided. The number of line items depends on how many

initiatives were approved by the voters within the property’s tax jurisdictions, as

well as additional levies approved by state legislation.

In the example tax statement, there are 43 line items across six different tax jurisdictions.

These line items total 559.860 mills levied.

The mills levied is prominently displayed on tax statements.

4a. All properties within the same tax jurisdiction are subject to the same mill levy

All properties within the same tax jurisdiction are subject to the same mill levy, regardless of property class.

5. Property Taxes

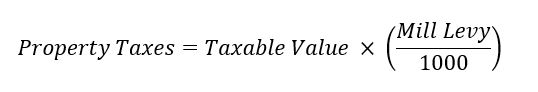

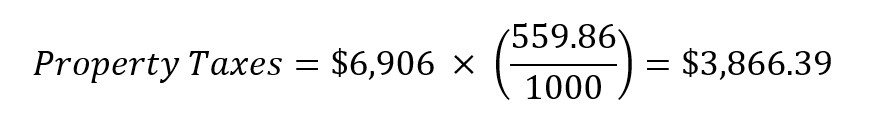

To calculate Property Taxes, apply the following formula:

Example

For the example tax statement, the calculation is:

5a. Special Assessments (add-ons)

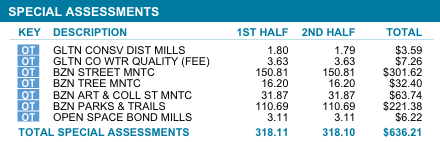

In addition to regular property taxes, a property tax statement may include special

assessments – additional charges imposed by a tax jurisdiction to fund specific public

projects and services that directly benefit the property. Projects include street

paving and repairs, sewer and water system upgrades, boulevard maintenance, sidewalk

installation, and streetlights or other local infrastructure improvements. These are

usually flat fees and are listed as line items line under Special Assessments on your

property tax bill.

Example

In the example tax statement, there are three special assessments totaling $636.21. The first is the Gallatin County Conservation District Mills, amounting to $3.59.

5b. Total Property Taxes

Total Property Taxes equal the sum of the property taxes owed and any special assessments:

![]()

In Montana, property taxes are divided into two equal payments, one in May and another in December of the subsequent tax year.

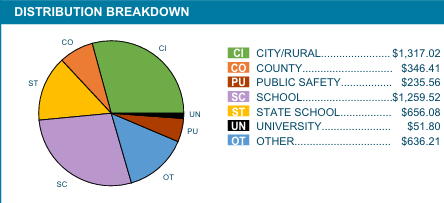

5c. One Tax Bill for All Tax Jurisdictions

In Montana, the county is responsible for administering property tax statements on behalf of all applicable tax jurisdictions. This means that property owners receive a single tax bill that includes taxes from various jurisdictions (such as city, county, school district, and other special districts). Once the payment is made, the county transfers the funds to the respective tax jurisdictions on the property owner's behalf.

Example

The statement provides a summary of how much taxes are paid to each tax jurisdiction.

This is Part 1 Revised for 2025 of a Series on Property Taxation in Montana.

View Other Related Blog Posts:

- Why Did My Property's Taxes Increase? Part 2

- The Fixed Mill Levy Issue: Why Montana's 95 Mill Levy is Unstainable in the Long Run Part 3

- Tax Policies and Shifting Tax Burden Between Property Classes Across Montana Part 4

- The Economics of Property Tax Policies Part 5

- The Economics of Property Tax Force Recommendations Part 6

- Current Property Tax Proposals in the 69th Montana Legislature Part 7

- Unpacking SB 542 and HB 231 Property Tax Reforms Part 8

Greg Gilpin

Professor

Montana State University is an ADA/EO/AA/Veteran’s Preference Employer and Provider of Educational and Outreach.

Source: Andrey Popov

Source: Andrey Popov